InvoiceNow consists of the transmitting and processing of automated invoices from one party to another.

There will be no need for the business to manually handle the invoice as the invoices are sent to the buyer’s Peppol-Ready accounting system through the secure network.

It is unlike sending a PDF file or a physical invoice. This reduces the cost and time spent on handling invoices manually.

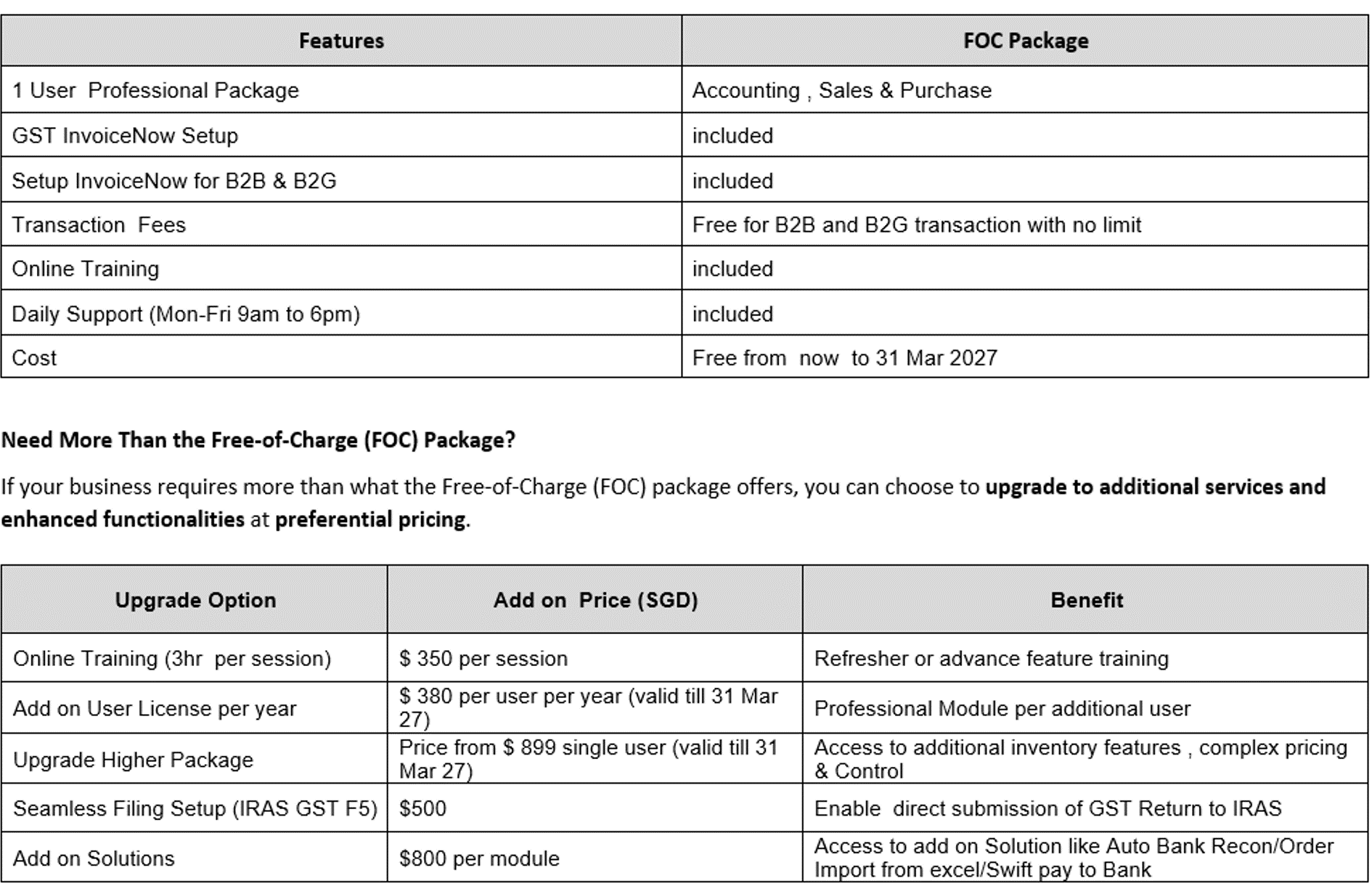

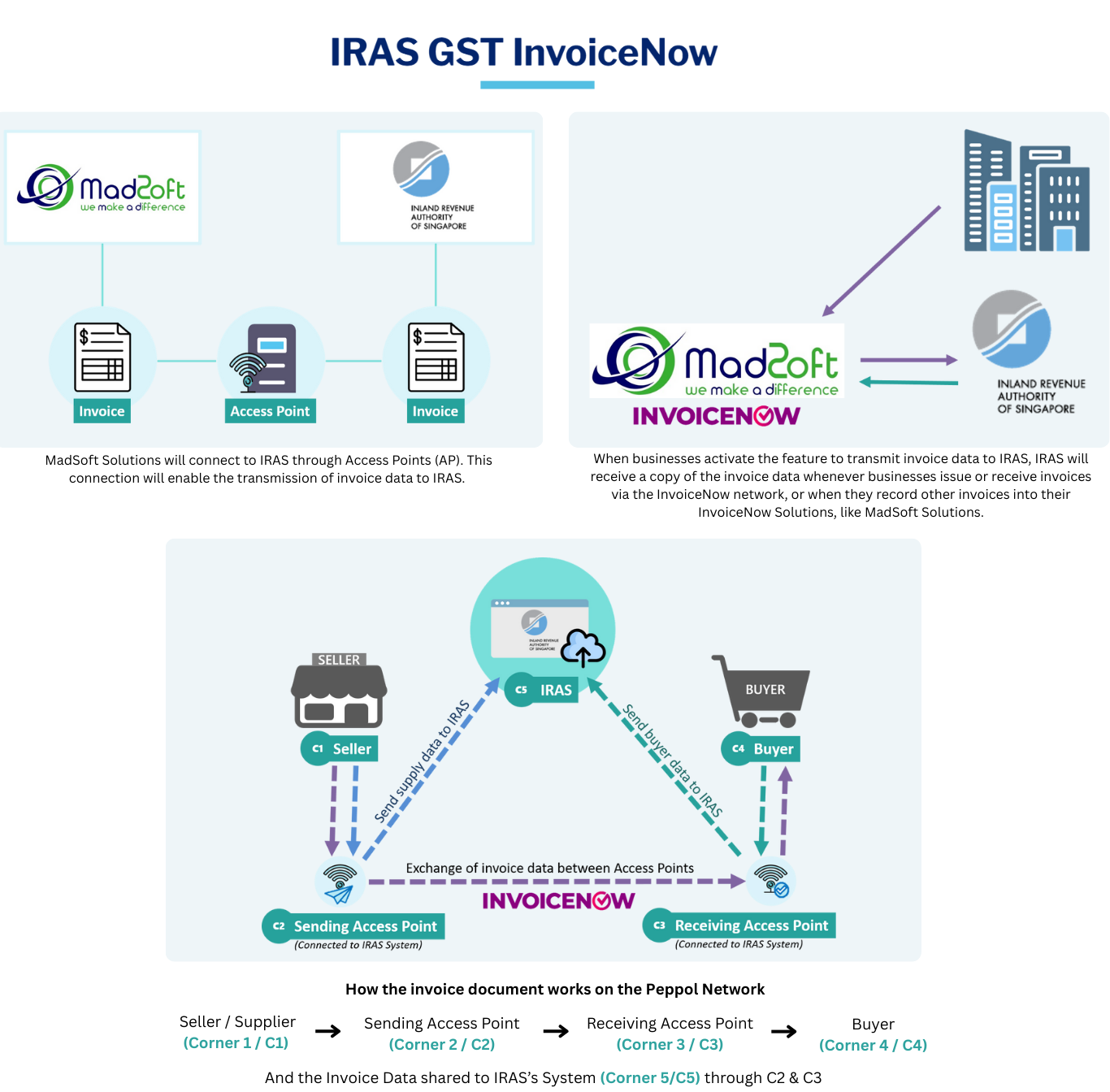

On the Peppol network, an invoice document is firstly created by the supplier (known as Corner 1 or C1), and sent to their Access Point (known as Corner 2 or C2). C2 will send the invoice document to the buyer’s Access Point (known as Corner 3 or C3), who, will then forward the same to the buyer, (known as Corner 4 or C4). Working in conjunction with the Peppol Network, invoice data will be channelled to IRAS system (C5) via C2 and C3. To provide better understanding of mechanism for invoice data submission, we have classified each transaction type based on the business’ point of view.

📝 Sign Up Now

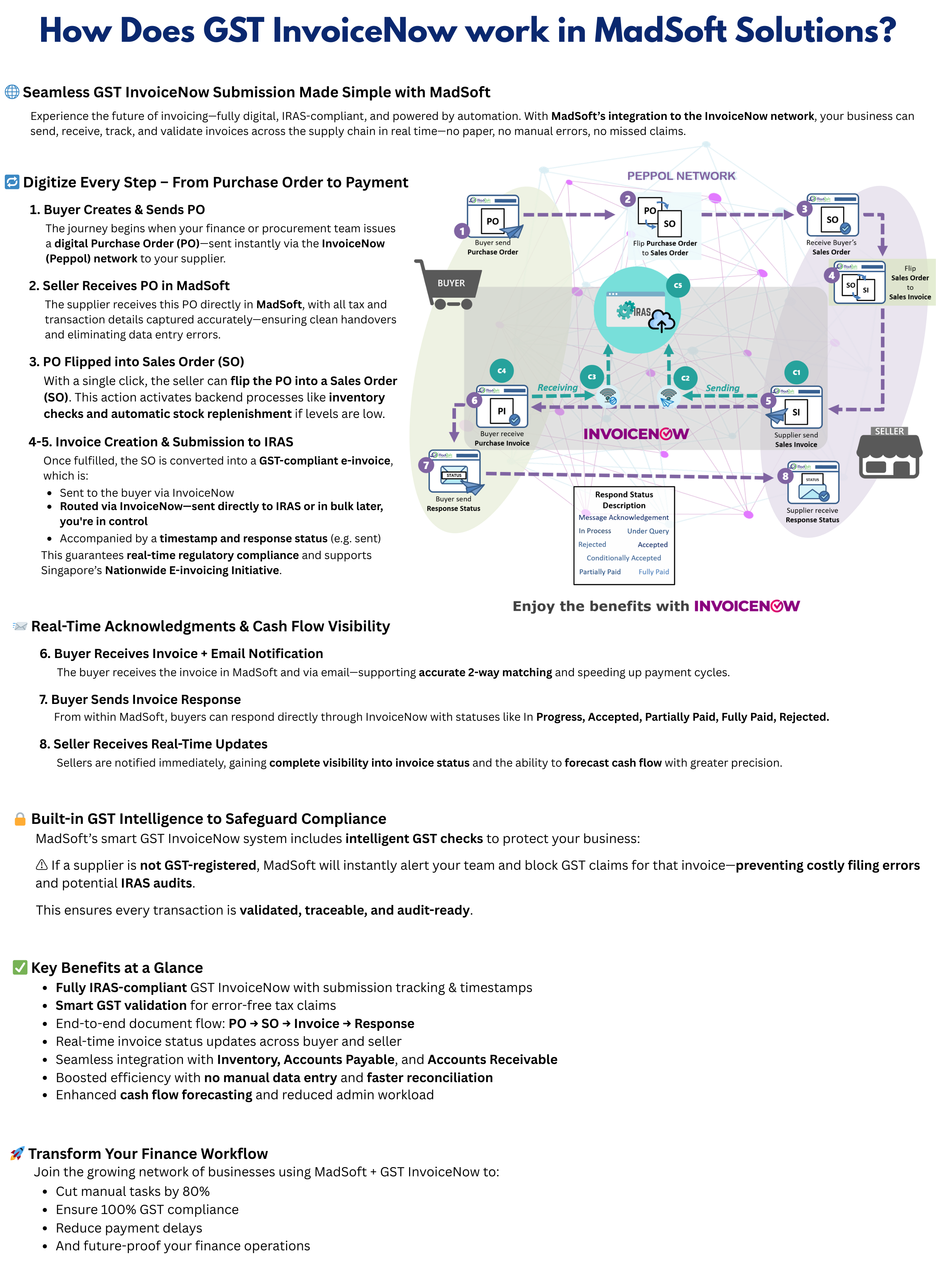

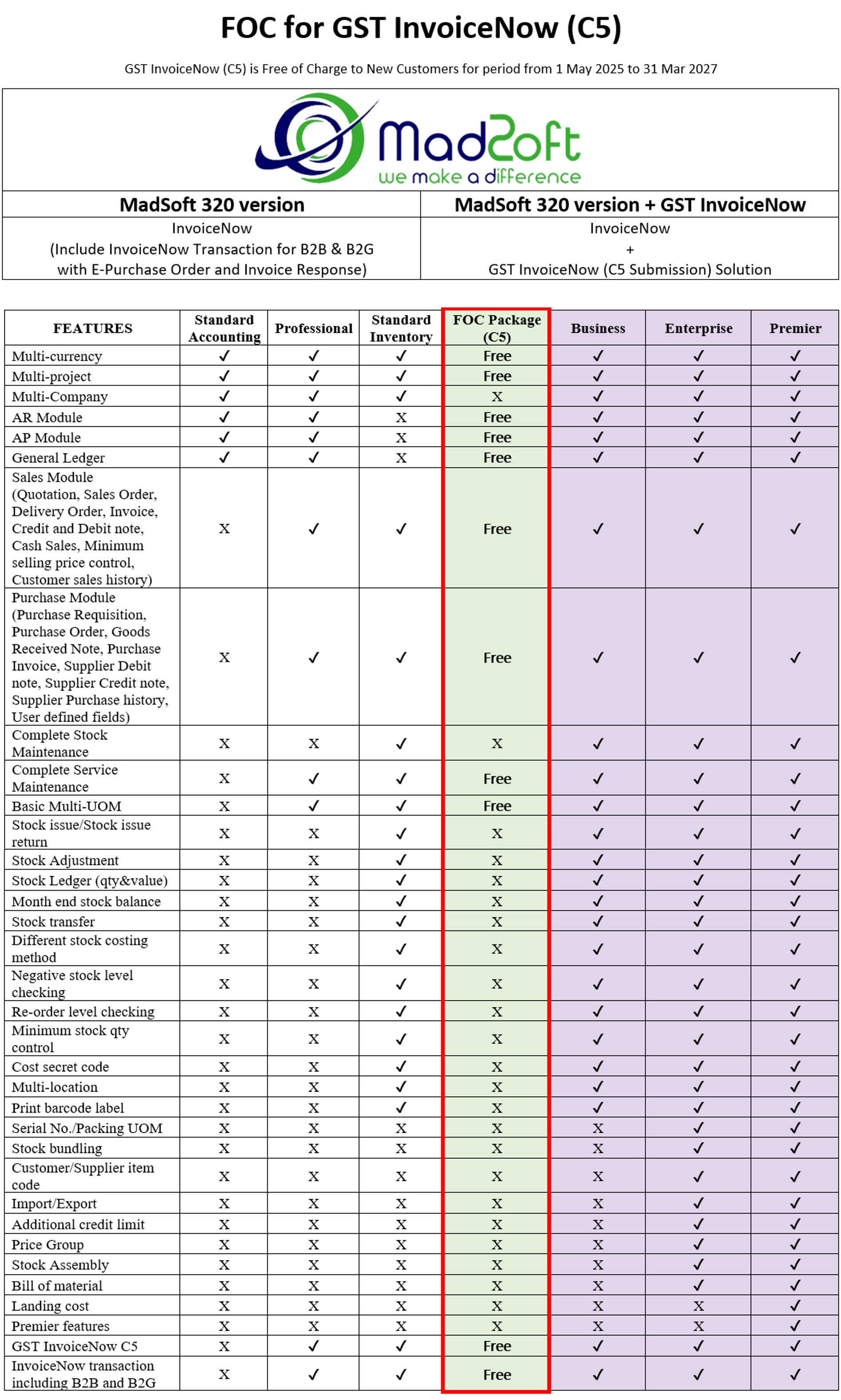

If your business is GST-registered and you’re ready to onboard. FOC package applies to new sign-ups only. Existing customers eligible only for newly registered companies.

Efficient

Increases Efficiency as time is saved when employees need not print out invoices and mail it out. It gives employees more time to focus on their delegated activities.

Save Cost

Save Cost as there is reduction in material costs (i.e. paper, stamps, printing).

Error Reduction

There will be no need for data entry, which will curb human error.

Process Payment Faster

Less time is needed in processing or lost invoices. This will ensure that payment can be made on time.

Better Cash Flow Management

Automated invoice processing and ensure consistency of payment timings.

🚀 Early Adoption Advantage

Pilot your workflow during the soft launch and ensure full compliance before mandatory rollout.

🛡️ Lower Risk of GST Audits

With improved IRAS risk analysis, audits are fewer and resolved faster.

📊 Built-In Tax Compliance Tools

📁 Powerful Reconciliation & Reporting

GST-registered businesses must meet specific eligibility criteria. If you are unsure whether your business qualifies, you can:

Check Your GST Obligations

Businesses with an annual taxable turnover exceeding SGD 1 million must register for GST, while others may opt for voluntary registration.

Use IRAS' GST Registration Tool

Visit the IRAS GST Registration Tool to determine your GST eligibility.

Consult a Tax Professional

Seek advice from an accountant or tax advisor to understand the best approach for your business.

- 01GST InvoiceNow FAQ

- 02InvoiceNow FAQ

What is the typical lead time for a business to onboard InvoiceNow-Ready Solutions, connect to IRAS and to be able to start transmitting invoice data to IRAS?

Many popular accounting and finance solutions are already integrated with InvoiceNow capabilities or are compatible with InvoiceNow. Many free solutions also come with basic InvoiceNow capabilities. Businesses using such solutions only need to activate the GST InvoiceNow submission feature to start sending invoice data via the InvoiceNow network

For businesses using in-house enterprise solutions, you can get in touch with IMDA accredited Access Point Provider to connect to the InvoiceNow network. Working alongside your Access Point Provider, you will need to ensure that your solution is connected to IRAS via API and that the GST InvoiceNow submission feature is enabled. The entire process for system connection and testing can be accomplished in as little as 3 months, with most businesses fully onboard within a year. IMDA will publish a list of accredited Access Point Providers in April 2025.

We encourage businesses to plan ahead by taking the steps set out above under “Preparing Early to Adopt GST InvoiceNow-Ready Solutions”.

With the invoice data submitted to IRAS, does that mean that businesses no longer need to keep their records?

Businesses need to continue to adhere to the prevailing record keeping requirements, which remain unchanged. The adoption of the GST InvoiceNow Requirement does not preclude businesses from having to comply with the mandatory record keeping requirements for GST-registered businesses.

Will I be penalised for any errors made on invoices sent to IRAS?

As a GST-registered business, you continue to be responsible for your GST obligations. These include ensuring that you comply with invoicing requirements when issuing an invoice electronically and report accurate GST returns. If you have made any errors, you may voluntarily disclose your errors and make good any tax that had been overclaimed or under-accounted for. Errors voluntarily disclosed within a grace period may qualify for penalty waiver or reduced penalties, subject to conditions under the Voluntary Disclosure Programme.

How will the invoice data transmitted to IRAS be stored? Is my data secure?

The invoice data will be stored in IRAS’ system, which is governed by public sector security requirements. IRAS is committed to safeguarding the confidentiality and security of our taxpayers’ data and upholding high standards of accountability. Refer to our Data Protection Statement and Privacy Statement for more information on how we handle the data that you have entrusted to us securely.

What is InvoiceNow?

InvoiceNow allows direct transmission of invoices in a structured digital format from one finance system to another using the Nationwide E-delivery network, which is based on Peppol , creating opportunities for automation. As such, both SMEs and large enterprises can enjoy smoother invoicing and faster payments, with shorter invoicing processing time without any manual paperwork.

I am already using PDF E-Invoice, why is InvoiceNow different?

In a common business scenario today, an PDF e-invoice is sent to the recipient organisation by email. This is a single-sided operation requiring your recipient to re-enter the details of the invoice into their own accounting system (e.g. accounts payable). A more complete solution should include the transmission of data from supplier system to buyer system without human intervention and potentially allow for the InvoiceNow invoice to be paid seamlessly.

What is Peppol?

Peppol is an international E-Document delivery network and business document standard form of Electronic Data Interchange (EDI) allowing enterprises to digitally transact with other linked companies on the Network.

Is InvoiceNow e-invoicing different from Peppol e-invoicing?

No, InvoiceNow e-invoicing is based on the Peppol business document standard and operates over the Peppol network and allowing enterprises to digitally transact with other linked companies on the Network.

More Questions about InvoiceNow?